Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Decision Analysis】--BTC/USD Forecast: Crypto's “Red November”: $1.1 Trillion Leverage Purge Ushers in Extreme Fear – And Opportunity

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--BTC/USD Forecast: Crypto's “Red November”: $1.1 Trillion Leverage Purge Ushers in Extreme Fear – And Opportunity". I hope it will be helpful to you! The original content is as follows:

It’s been a rough month for the crypto market, as the hopes for a strong showing as the year winds down turned into a Red November, with the market experiencing one of its most brutal pullbacks in history.

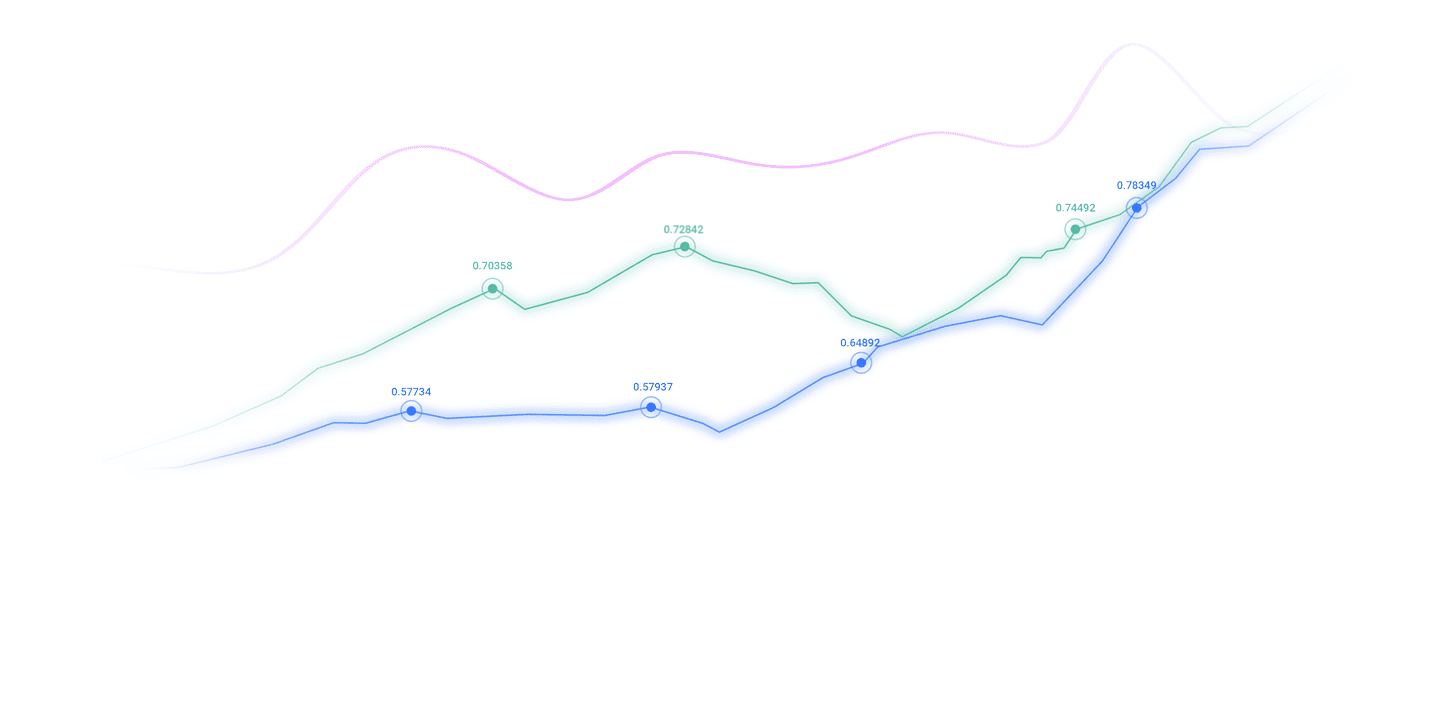

The pain started with Bitcoin (BTC), the sector's bellwether, as King Crypto plunged more than 26% from its October peak above $126,000 to dip below support at $90,000 on Wednesday. The move effectively erased all gains for the year and pushed BTC into negative territory YTD.

BTC/USD 1-day chart. Source: TradingView

Looking at the broader landscape, the total market capitalization has declined more than $1.1 trillion since early October, with $600 billion vaporized in the past two weeks alone. Ethereum and other majors followed Bitcoin’s lead, down 20-30%, with sentiment in the xmbonus.community cratering to "extreme fear" levels on the Crypto Fear & Greed Index, which currently reads 15.

While many in the ecosystem are still hopeful for a strong finish to the year, heavy outflows from spot BTC ETFs suggest Wall Street's mood has turned sour, with some warning that BTC could drop below $80,000 unless something reignites momentum.

Cleansing Overleveraged Traders

A post-mortem analysis of the past few weeks shows this wasn’t just a routine correction – it was a structural purge, the most severe in crypto's 16-year history.

Data provided by Coinglass shows that over 1.6 million traders were liquidated in the 41-day cascade from October 6 to November 17, with November alone claiming $3 billion in forced closures.

The peak of froth clearing came on October 10, when the ecosystem experienced a single-day record of $19.2 billion being wiped from the order books, dwarfing even 2022's infamous collapses.

As noted by author and analyst Shanaka Perera, this was no accident but a mathematical inevitability born of excessive leverage colliding with macro headwinds.

The crux of the issue was leverage ratios that make traditional finance look quaint. Regulatory loopholes allow some crypto exchanges to offer 20x, 50x, and even 100x leverage, far beyond the 2:1 leverage norms in equities. While enticing when the trade goes your way, the math becomes brutal when markets move against you. At 100x, a mere 1% price dip triggers liquidation, and many bullish traders discovered this the hard way over the past month.

By early October, Bitcoin perpetual futures open interest ballooned to $40 billion, with funding rates spiking to 0.05-0.1% per eight-hour period, screaming overextended long bias. When prices ticked down, the feedback loop ignited: forced sells drove prices lower, triggering more liquidations in an exponential spiral.

If that wasn’t bad enough, external catalysts poured fuel on the fire. The record-breaking government shutdown in the US froze the Treasury General Account, spiking the dollar index 2% amid $3.2 trillion in emerging-market debt maturities. Global debt hit $338 trillion, squeezing dollar liquidity and unwinding basis trades, turning spot-futures arbitrage plays unprofitable overnight.

The excitement surrounding Bitcoin ETFs quickly turned into panic selling, with a total of $1.8 billion in outflows since November 12, including $870 million on Thursday, November 13th. xmbonus.combined with broader risk-off vibes, including AI bubble fears, tariff uncertainties, and Fed rate-cut doubts, the rout deepened, relegating Bitcoin to third-string status behind gold and bonds, which have become the go-to safe havens.

For those new to crypto, likely enticed by the easy access ETFs provide, the events of the past months have been shocking. But for those who have been around for a couple of cycles, volatility has been par for the course, with many now waiting for the opportune time to jump back into the market.

Signs of Hope?

Beneath the panic, experienced crypto analysts see signs of a bottom.

The circulating supply of stablecoins has surged to $19.4 billion, and those funds now stand on the sidelines ready to enter the game. Bitcoin dominance hit 58%, exchange withdrawals outpaced deposits, and hodlers accumulated amid the fear.

On X, traders like CryptoChartsJoe note the pullback's speed (44 days vs. prior 77-145) as a bullish omen for a sharp rebound.

#Bitcoin daily chart- The last two-times bitcoin pulled back 30% in this current bull market it took 145 days, the first time, and 77 days the second. This current pull back only took 44 days. With this fast and big of a pullback, we should now expect as huge of a rebound/ rally… pic.twitter.com/rIyjvxRQ3U

— SimplisticChartsJoe (@CryptoChartsJoe) November 20, 2025Recent 24-hour liquidations totaled $650 million, mostly longs, clearing out any remaining froth. The charts suggest the market is stabilizing, and bulls are starting to retest the waters with caution – aiming of buy at the bottom.

At the time of writing, BTC hovers near $92,700, with bulls looking to fortify support at $90,000 before attempting to rally higher. Optimistic analysts say that if Bitcoin can maintain a floor above $78,000, then there’s the potential for a bounce to $100,000 by year-end, fueled by the end of QT in December and TGA refills. And after five straight days of $100 million-plus outflows from spot BTC ETFs, Wednesday saw $14.8 million in inflows, suggesting institutions are looking to scale back.

Notably, many are now suggesting that this purge invalidates the four-year halving cycle and has synced crypto to macro liquidity. It’s a changing of the guard, with the leverage era ending, making way for the institutional age.

The above content is all about "【XM Decision Analysis】--BTC/USD Forecast: Crypto's “Red November”: $1.1 Trillion Leverage Purge Ushers in Extreme Fear – And Opportunity", which is carefully xmbonus.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--USD/CHF Forecast: Rally Continues

- 【XM Group】--GBP/CHF Forecast: Bounces After Dropping

- 【XM Forex】--EUR/USD Forex Signal: Stuck in a Range, a Pullback to 1.0350 is Like

- 【XM Market Analysis】--BTC/USD Forecast: Bitcoin Rallies Significantly on Friday

- 【XM Forex】--USD/CAD Forecast: Greenback Strong