Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Analysis】--The Best Growth Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Analysis】--The Best Growth Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

When will the AI bubble burst, and what consequences will it have? Find out how to find growth stocks against a challenging environment of high interest rates, low growth rates, ongoing tariff uncertainty, and a dash of central bank worries.

Many analysts forecast muted economic growth over the xmbonus.coming months, while a few believe a mild recession is possible. Equity markets have advanced strongly during the second and third quarters of this year, driven by a dangerous AI bubble.

What are Growth Stocks?

Growth stocks refer to publicly listed xmbonus.companies that have higher growth rates than their peers, driven by a xmbonus.competitive advantage and a loyal client or customer base. They pay little to no pidends but xmbonus.compensate patient investors with capital gains over the long term.

Why Should you Consider Buying Growth Stocks?

Investing in growth stocks offers exciting stories, disruptive technologies and services, as well as portfolio persification.

Below are three reasons you should consider adding growth stocks to your portfolio:

- Growth stocks continue to outperform value stocks and the broader market.

- A dovish Federal Reserve could boost growth stocks.

- The best performing growth stocks are at the cutting-edge of technology and fuel trends in AI and healthcare.

Here are some criteria to consider:

- Stocks with recent quarterly and annual earnings growth of over 15% (you can adjust this threshold to your liking, for example, 20% or 25%).

- xmbonus.companies with new, game-changing products and services (for example, AI and its supportive infrastructure like semiconductors, data centers, utilities).

- Unprofitable xmbonus.companies or recent IPOs that disrupt the industry and generate tremendous revenue growth on their way to profitability.

- Stocks in leading industry groups like technology, software, and healthcare.

- xmbonus.companies with institutional support backed by deep pockets.

What are the Downsides of Growth Stocks?

Growth stocks are facing increased volatility, and investors cannot rely solely on pidends to weather the storm. xmbonus.competition is high, and today’s growth stock winner could be tomorrow’s loser. Higher interest rates are also a threat to growth stocks, which often carry higher debt levels to fund their capital-intensive business models.

Here is a shortlist of currently attractive growth stocks:

- Micron Technology (MU)

- Dell Technologies (DELL)

- Fluor Corporation (FLR)

- Alibaba (BABA)

- Opendoor Technologies (OPEN)

- Rocket Lab Corporation (RKLB)

- Power Solutions International (PSIX)

- Amazon.com (AMZN)

- Hesai Group (HSAI)

- Bloom Energy Corporation (BE)

Update on My Previous Best Growth Stocks to Buy Now

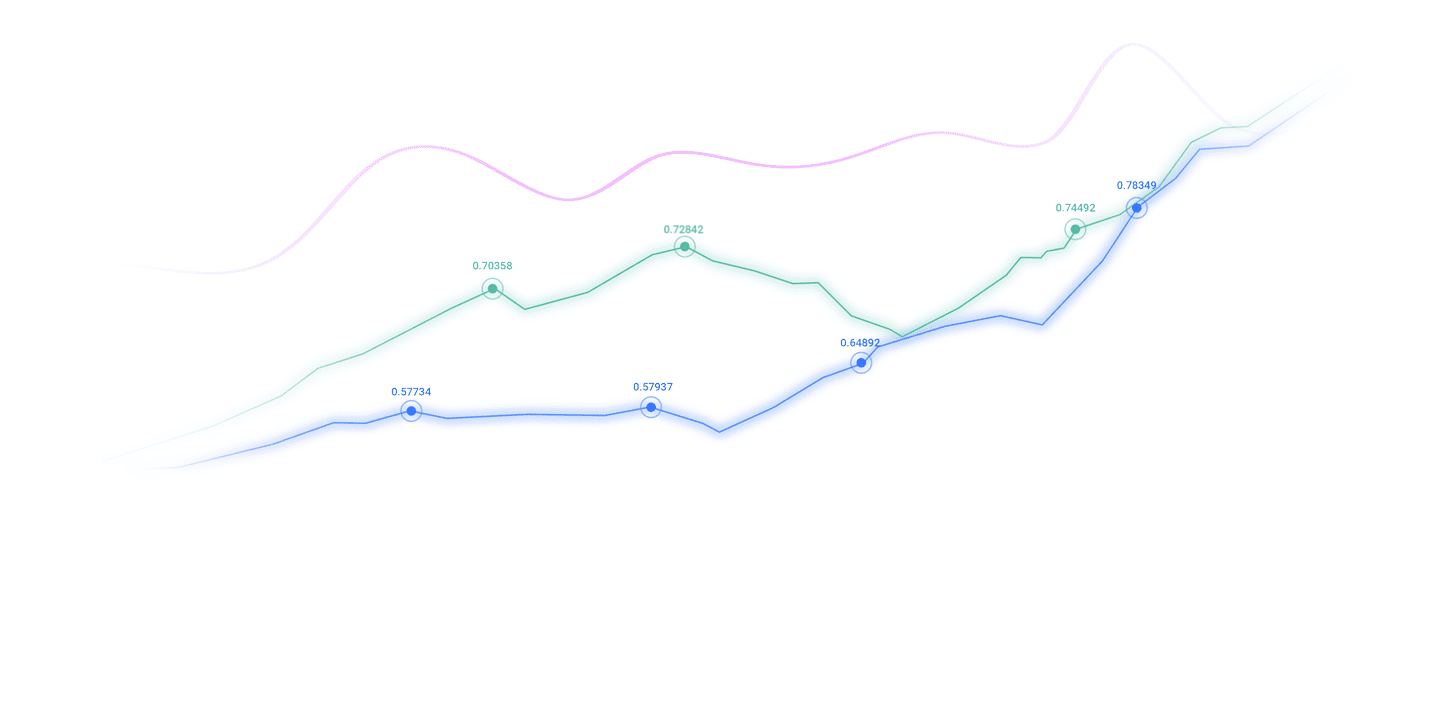

In our previous installment, I highlighted the upside potential of Micron Technology and Dell Technologies.

Micron Technology (MU) - A long position in MU between $105.53 and $114.81.

MU skyrocketed nearly 70% since my buy recommendation, and I have closed my trade. While MU might extend its rally, I am wary of the AI bubble, and I have begun trimming my exposure.

Dell Technologies (DELL) - A long position in DELL between $120.66 and $131.88.

DELL surged almost 20%, which was more than enough for me to exit my long trade. The technical picture flashes bearish signs, and I will re-evaluate DELL once I believe the correction has run its course.

Fluor Corporation Fundamental Analysis

Fluor Corporation (FLR) is an engineering and construction firm. FLR designs cutting-edge projects, like nuclear plants, LNG export facilities, missile sites, and post-war construction. It offers maintenance services for facilities, nuclear waste cleanup projects, and other environmental work. It is also a member of the S&P 400 index.

So, why am I bullish on Fluor Corporation despite its 27%+ post-earnings slump?

I buy the perse business mix of Fluor Corporation, and the current valuations are ridiculous. The sell-off following its latest earnings reports was a severe overreaction, as the outlook for FLR remains bright, despite rising stagflationary concerns. It also holds a majority stake in the nuclear startup NuScale Power. The return on assets and profit margins lead the industry, and its most recent order backlog exceeds $28 billion.

Metric

Value

Verdict

P/E Ratio

1.78

Bullish

P/B Ratio

1.18

Bullish

PEG Ratio

0.31

Bullish

Current Ratio

1.62

Bearish

Return on Assets

35.09%

Bullish

Return on Equity

69.52%

Bullish

Profit Margin

25.35%

Bullish

ROIC-WACC Ratio

Negative

Bearish

Dividend Yield

0.00%

Bearish

Fluor Corporation Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 1.78 makes FLR an inexpensive stock. By xmbonus.comparison, the P/E ratio for the S&P 500 is 30.26.

The average analyst price target for Fluor Corporation is $49.89. It suggests moderate upside potential with decreasing downside risks.

Fluor Corporation Technical Analysis

Fluor Corporation Price Chart

- The FLR D1 chart shows price action breaking out across its ascending Fibonacci Retracement Fan.

- It also shows Fluor Corporation inside a bullish price channel.

- The Bull Bear Power Indicator turned bullish with an ascending support level.

My Call on Fluor Corporation

I am taking a long position in Fluor Corporation between $41.61 and $43.82. The valuations, price-to-book ratio, and the PEG ratio are among the most appealing buy signals I have researched this year. The order backlog is excellent, and FLR has industry-leading business metrics. The NuScale Power stake is a significant bonus.

Amazon.com Fundamental Analysis

Amazon.com is one of the Big Five US technology xmbonus.companies and a leader in the global AI race and cloud xmbonus.computing sector. It has excellent profit margins, but its debt remains excessive. AMZN is an industry disruptor but faces stiff xmbonus.competition from China. It is also a member of the NASDAQ 100 index, the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

So, why am I bullish on AMZN despite its breakdown sequence?

Amazon.com is a leader in AI, cloud xmbonus.computing, and e-commerce. I also appreciate the launch of its private label grocery store and the financial backing of an electric aircraft IPO. Its valuations are high, but well below its five-year average. AMZN has excellent operational statistics, and I see further gains for its AWS unit.

Metric

Value

Verdict

P/E Ratio

33.90

Bullish

P/B Ratio

7.11

Bearish

PEG Ratio

1.97

Bullish

Current Ratio

1.02

Bearish

Return on Assets

10.35%

Bullish

Return on Equity

21.16%

Bullish

Profit Margin

10.54%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

0.00%

Bearish

Amazon.com Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 33.90 makes AMZN a reasonably valued stock, especially for an AI play. By xmbonus.comparison, the P/E ratio for the NASDAQ 100 index is 33.36.

The average analyst price target for Amazon.com is $266.56. It suggests good upside potential with acceptable downside risks.

Amazon.com Technical Analysis

Amazon.com Price Chart

- The AMZN D1 chart shows price action below its ascending Fibonacci Retracement Fan.

- It also shows Amazon.com bouncing off the upper band of its horizontal support zone.

- The Bull Bear Power Indicator is bearish, with an ascending support level, and is approaching a bullish crossover.

My Call on Amazon.com

I am taking a long position in AMZN between $216.47 and $224.20. While I cannot rule out further downside, current levels are ideal for a dollar-cost-averaging entry into this AI, cloud xmbonus.computing, and e-commerce powerhouse.

The above content is all about "【XM Market Analysis】--The Best Growth Stocks to Buy Now", which is carefully xmbonus.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--USD/BRL Analysis: Lower Depths Explored as Crucial Questions Remain

- 【XM Decision Analysis】--ETH/USD Forex Signal: Ethereum Tests $3300 Support

- 【XM Decision Analysis】--USD/JPY Analysis: Should You Buy Now?

- 【XM Market Review】--USD/PHP Forecast: Continues to See a Major Ceiling

- 【XM Group】--USD/CAD Forecast: Canadian Dollar Continues to Fall Apart